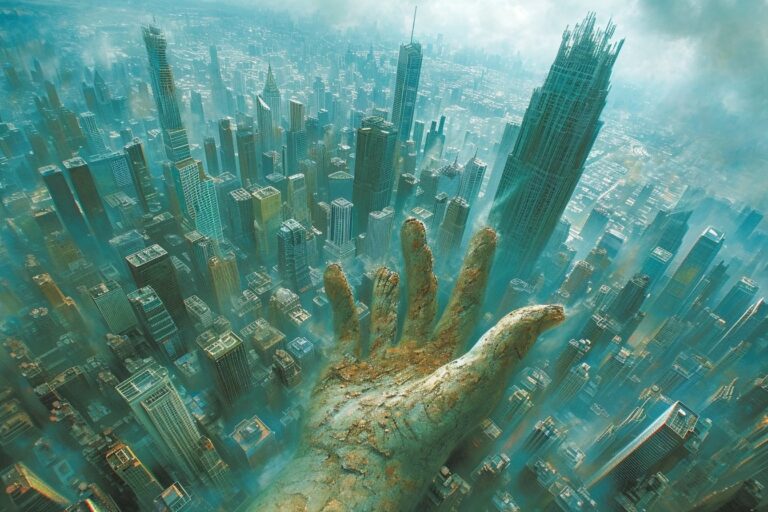

Remote Work Revolution Threatens Commercial Property Industry

The COVID-19 pandemic has entirely reshaped the way we work, with remote working becoming a common practice. As modern employees become increasingly likely to share an office at home rather than at a co-working space, the commercial property sector is significantly impacted.

Co-working giant WeWork was once valued at approximately $47 billion but now only boasts a net worth of $300 million. The company recently announced that it would renegotiate all its existing leases due to underutilized spaces in city centers and excessive expenses. With 777 rental locations across 39 countries and over $13 billion in financial commitments, WeWork’s potential downfall indicates dire consequences for landlords left with empty offices in the event of bankruptcy.

In the United States, the real estate crisis appears to be centered around the declining demand for office spaces, particularly in metropolitan areas such as New York City and San Francisco.

American Workers Remain Hesitant About Returning to the Workplace

Fewer workers are willing to return to conventional office settings, severely affecting large cities’ commercial industries. For example, New York Mayor Eric Adams has continuously encouraged constituents to get back to in-person labor but struggles to enforce this method for municipal employees.

WeWork functions as a minimal part of Manhattan’s office market at just 1.5%, but it was responsible for nearly 25% of fresh commercial leases within the city during Q1 2023. Thus, the company’s troubles add complexity to an already struggling market.

Tenants are opting to move towards higher quality accommodations when given the choice, leaving landlords scrambling to make substitutions even if it means lowering prices. Sage Realty, for example, chose to lease its Madison Avenue spaces formerly occupied by WeWork to the Spanish bank Santander.

New York’s Real Estate Divide Widens

WeWork has typically occupied older properties within the city, and as it experiences difficulties, a broader gap between modern and aging buildings emerges. For instance, investments in luxurious areas like Hudson Yards or One Vanderbilt Tower offer top-tier New York City views and amenities, whereas older structures are long-neglected and have limited resources available for updates.

Impacts on Residential Real Estate

So far, residential real estate has remained relatively stable throughout the challenges faced by commercial property sectors. However, critical factors contributing to potential catastrophe seem to be gathering momentum, with many businesses opting for remote work models even after pandemic fears subside. If this pattern continues, demand for office and shared working spaces could continue to plummet, affecting both landlords and individuals alike.

- In the United States, the real estate industry is grappling with a crisis primarily in the office sector, driven by decreased demand for co-working and conventional office spaces in major metropolitan cities.

- The downfall of commercial giants such as WeWork could leave landlords with vacant offices that add uncertainty to the market.

- Tenants are increasingly searching for higher-quality accommodations, forsaking outdated buildings and adding pressure to struggling markets.

- If current trends persist, the future of residential real estate may also come into question as the impacts of the changing workspace landscape become more apparent.

As the United States grapples with a quickly shifting real estate landscape amidst increasing remote work adoption rates, the fate of commercial properties hangs in the balance. Consequently, the wider economy must adapt and brace for potential fallout as businesses, landlords, and individuals reckon with the changing demands of modern workspaces.