Fed Announces an Interest Rate Hike

The American central bank, the Federal Reserve (Fed), recently announced a significant interest rate hike of 75 basis points, raising rates to 4%. In a note, AXA IM highlights that the Fed Chairman Jerome Powell explained the central bank is moving from rapid rate hikes for tightening monetary policy to a slower pace. The main goal is to ensure a return of inflation to its target level of 2%.

However, markets had anticipated a more favorable outlook than what was presented by Mr. Powell. Persistence in the labor market resiliency and inflation led to a tightened monetary policy. Although the path towards stabilizing the economy has narrowed dramatically, the Fed holds expectations of achieving this arbitrary target before cutting back on measures taken.

Forecasting Further Rate Increases

AXA analysts have raised their forecast for March 2023, projecting rates of 5% by then. This increase is expected to bring about some headwinds in terms of economic activity over the next year.

Fed Chairman Powell stated that there’s still “a long way to go” regarding determining when rates are “tight enough,” but he anticipates them to be higher than initially estimated by September. He reassured markets of the Fed’s determination and patience in fulfilling its mission and added that the central bank isn’t inclined to reverse policy tightening too quickly.

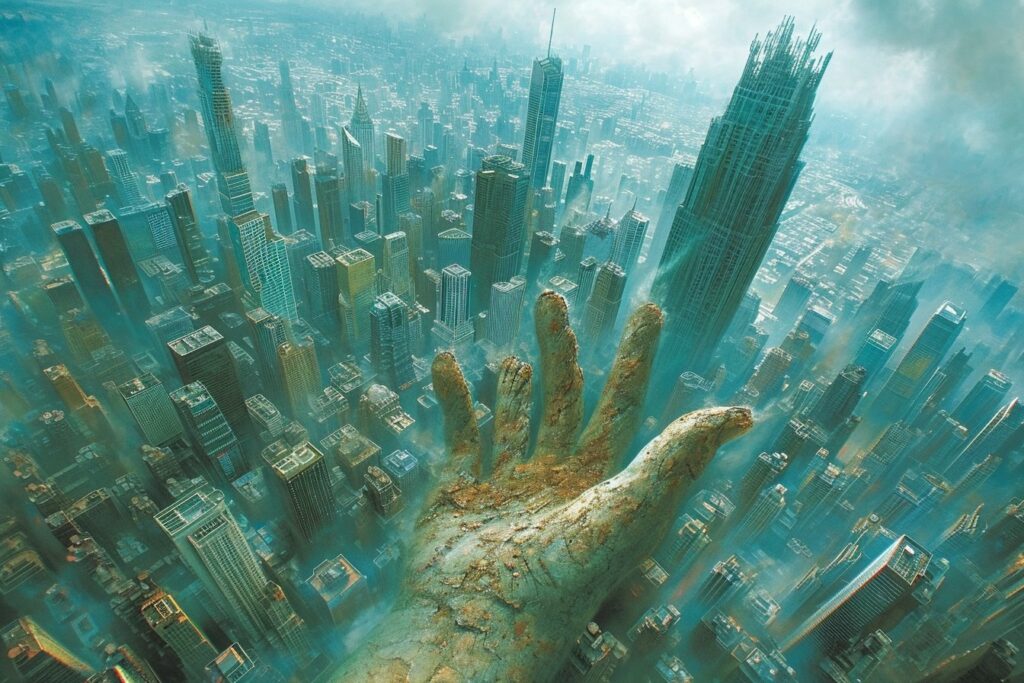

Real Estate Sector Already Feeling the Pressure

The US real estate market is starting to crack under pressure from rising interest rates. Recently, there has been a noticeable correction in property prices due to skyrocketing values and rapidly increasing variable rates. Even the wear rate isn’t able to keep up with these rapid fluctuations, resulting in significant financial roadblocks for the market.

- Rising interest rates make properties more expensive and further impact demand for property

- Higher mortgage rates lead to increased borrowing costs for buyers

- A potential decline in investment activities would slow down construction projects and housing developments.

France Following a Similar Trajectory

As demonstrated in the graph below, France’s real estate market is also experiencing similar issues due to rising interest rates. Just like in the US, record-low rates in France have provided a lifeline to struggling banks, allowing them to ease borrowers’ access to credit. However, as interest rates rise rapidly, financing becomes scarce, leading to subsequent declines in demand and pricing within the French property market.

Tightrope Walk of Monetary Policy

The Fed’s challenge lies in attempting to balance economic growth and inflation while reducing its footprint on the market. The goal is to preempt necessary adjustments instead of raising rates until the economy reaches a breaking point – an undertaking that pushes policymakers toward precision in their decision-making.

Ultimately, American real estate may face challenges ahead if monetary policy doesn’t strike a delicate balance amid changing factors. Buyers, sellers, and investors should prepare themselves for potential headwinds and fluctuations in the sector.

Keeping a Finger on the Pulse

Fed Chairman Powell emphasized the importance of timing when it comes to monetary policy tightening. Although there’s still uncertainty about how tight the purse strings should become before they’re loosened again, markets will continue to cautiously observe changes in central bank strategies throughout the process.

For real estate stakeholders, thorough examination of evolving market conditions and global influences remains crucial. The key to weathering the storm lies in preparedness and adaptability, allowing investors to capitalize on opportunities brought forth by market challenges.